Download PDF English | French | GERMAN

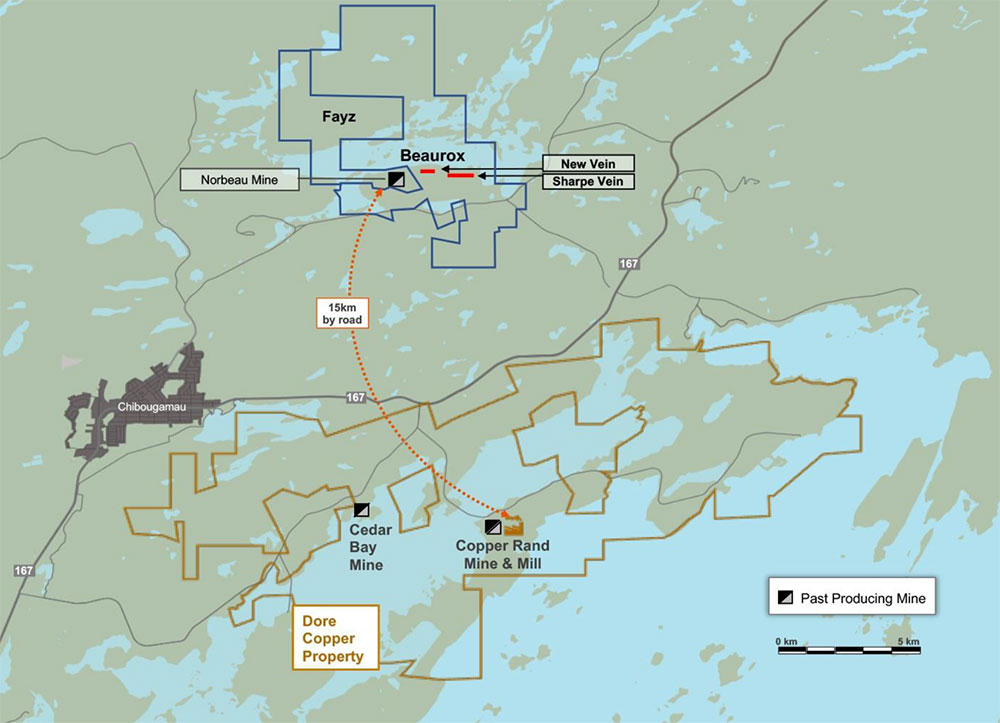

Toronto, Ontario – March 22, 2021 – Doré Copper Mining Corp. (the “Corporation” or “Doré Copper“) (TSXV: DCMC; OTCQB: DRCMF; FRA: DCM) is pleased to announce that it has entered into option agreements (the “Option Agreements”) to acquire a 100% interest in the former producing Norbeau gold mine property and the contiguous Beaurox property, a major land position totaling approximately 1,400 hectares (the “Properties”), located 15 kilometers by road north from the Corporation’s Copper Rand mill in the Chibougamau mining camp in northwestern Québec, Canada (Figure 1). All dollar amounts are stated in Canadian Dollars.

Highlights

- Cash payments totaling $465,000 over three years ($135,000 over the first year)

- Issuance of common shares in the Corporation (“Shares”) totaling $675,000 equivalent over three years

- Cash payments totaling $175,000 and issuance of a further $950,000 equivalent in Shares upon meeting certain technical milestones

- Spending commitments of $800,000 over 30 months

- Norbeau mine historical gold production of approximately 160,000 ounces (380,000 tonnes at 13.77 g/t) from 1965 to 1969; Lac Minerals sunk a 780-foot (238 meters) shaft eventually deepened to 1,580 feet (482 metres)

- On the Beaurox property to the east, trenching and limited shallow drilling identified additional veins (not mined) with intercepts of 4.1 g/t Au over 6 meters and 4.8 g/t Au over 2.8 meters at the Sharpe Vein and 10.8 g/t Au over 2 meters and 2.4 g/t over 14 meters at the New Vein (composite values)

- Limited or no drilling below 150-200 meters on both the Sharpe Vein and New Vein

- 2019 trenching at the New Vein encountered visible gold (Figure 2)

- No drilling or exploration on the Properties since the late 1980’s

Ernest Mast, President and CEO, commented, “The Properties provide an opportunity to further consolidate our position in the Chibougamau mining camp with high-grade copper and gold assets and build on our strategy to create a near-term, profitable hub-and-spoke operation with our centralized 2,700 tpd mill. The high-grade gold historically mined at Norbeau with limited and no modern exploration since the 1980s provides a unique low-cost exploration opportunity, particularly to the east of the Norbeau mine with the Sharpe and New Veins.”

Next Steps

The Corporation will be completing a detailed compilation of all available data on the Properties and initially plans to investigate both the New Vein and Sharpe Vein. Doré Copper is also planning an airborne geophysical survey for the second quarter of 2021.

Option Agreements

Under the terms of the Option Agreements, the Corporation may earn a 100% interest in the Properties under the following terms:

Norbeau Property

- $50,000 in cash payments and $175,000 equivalent in Shares following receipt of TSX Venture Exchange approval, $50,000 in cash payments and $75,000 equivalent in Shares on the first anniversary, $65,000 in cash payments and $100,000 equivalent in Shares on the second and third anniversaries for a total of $230,000 in cash payments and $450,000 equivalent in Shares

- $100,000 in expenditures in the first 16 months and $100,000 in expenditures in the subsequent six months

- $100,000 equivalent in Shares on filing a NI 43-101 Technical Report with mineral resources and a further $250,000 equivalent in Shares if the mineral resources (all categories) exceed 300,000 ounces of gold

- $150,000 equivalent in Shares on commencement of commercial production and a further $350,000 equivalent in Shares after production of 100,000 ounces of gold

- 2% net smelter return (“NSR”) royalty, of which 1% may be bought back for $2,000,000

Beaurox Property

- $35,000 in cash payments and $25,000 equivalent in Shares following receipt of TSX Venture Exchange approval, $50,000 in cash payments and $50,000 equivalent in Shares on the six-month anniversary, and on the first, second and third anniversaries for a total of $235,000 in cash payments and $225,000 equivalent in Shares

- $300,000 in expenditures in the first 18 months and $300,000 in expenditures in the subsequent six months

- $75,000 in cash payments on commencement of drilling and $100,000 in cash payments after completion of 5,000 meters

- 5,000 meters of drilling or cumulative equivalent expenditures prior to the third anniversary

- $100,000 equivalent in Shares on filing a NI 43-101 Technical Report with mineral resources

- $150,000 equivalent in Shares on commencement of commercial production

- 2% NSR royalty, of which 0.75% may be bought back for $3,000,000, and approximately $60,000 in advance royalty payments commencing in year three

The terms and conditions of the Option Agreements are subject to the receipt of all necessary approvals, including the acceptance of the TSX Venture Exchange. Shares issued pursuant to the Option Agreements will be subject to a four month hold period under applicable Canadian securities laws.

About the Properties

The Beaurox property is comprised of 28 unpatented mining claims covering approximately 1,000 hectares and the Norbeau property is comprised 11 claims totaling 386 hectares.

Norbeau Mine (see Note 1)

The Norbeau mine historically produced approximately 160,000 ounces of gold from 1965 to 1969 at a grade of 13.77 g/t Au. Approximately 80% of the production was from the Main Vein (Vein #1) and 20% from Vein #4. The shaft extends to 1,580 feet (482 metres) with 10 levels but little or no development on the last two levels. In 1980-81, the Norbeau mine was dewatered to a depth of 1,580 feet and 13 underground holes totaling 762.2 meters were completed to test Vein #9, a low-grade east-west structure in the footwall of the lower level stopes. In 1987, Westminer Mines Ltd. completed six surface drill holes totaling 3,426 meters to intersect the extension of Vein #4 below the 10th level of the mine. Vein #4 was not intersected but new gold-bearing veins were found in the upper levels and below the 10th level. The best intercept of the program returned 9.09 g/t over 2.6 meters (0.265 oz/t over 8.6 ft) in Vein #9 from 1,265.8 to 1,274.4 feet. No other work is reported after this period at the Norbeau mine.

New Vein (see Note 2)

The New Vein (also referred to as the Shecapio Vein), located approximately 500 meters east of the Norbeau shaft, was discovered in 1980 and outcrops over a length of approximately 250 meters with an average width of 3 meters. During 1980-81, the New Vein was channel sampled and 42 short surface drill holes totaling 2,900 meters were completed along an east-west strike length of 300 meters. Significant intercepts included 10.8 g/t Au over 2 meters (N-81-35), 2.4 g/t Au over 14 meters (N-81-11), and 11.2 g/t Au over 2 metres, including 95.3 g/t Au over 0.2 meters (N-81-22). The New Vein has not been drill tested at depths below 100-150 meters.

Sharpe Vein (see Note 3)

The east-west Sharpe Vein, located a further 500 meters to the east, was channel sampled over the 203.8 meters length of the vein exposure by Beaurox Mines Limited in 1982. The grade was established at 6.86 g/t (0.20 oz/t) Au over an average width of 2.9 meters (undiluted and all samples cut to 1.00 oz/t Au), including 124.8 meters grading 8.23 g/t (0.24 oz/t) Au over an average width of 3.29 meters. In 1985, a systematic re-sampling of the Sharpe Vein was carried out with 87 channel samples and 21 holes totaling 1,128 meters over a strike length of approximately 350 meters (including 18 short holes totaling 873.9 meters on 50 feet sections testing 50 feet below surface). Significant intercepts included 4.1 g/t Au over 6 meters (SH-9-85)and 4.8 g/t Au over 2.8 meters (N-98). In 1987, two holes totaling 354.8 meters were drilled to test the Sharpe Vein to a depth of 100 meters with no significant gold intercepts. The Sharpe Vein has not been drill tested at depths below 100-150 meters.

Vein #5 (see Note 4)

Other veins include Vein #5, which is located at the west end of the Sharpe Vein and strikes northwest. In 1985, seven holes were drilled over a strike length of 140 meters. The best value was 5.0 g/t (0.146 oz/t) Au over 1 meter (hole 5-4-85). Vein #5 was channel sampled fairly systematically over a strike length of 45 meters in 2015. The sampling returned an average of 6.84 g/t Au over a length 45.4 meters with average widths of 1.61 meters.

Reference Notes

Historical production from the Norbeau mine and historical channel sampling and drilling results disclosed in this news release on the Properties are taken from the following sources:

- Ministry of Energy and Natural Resources, SIGEOM Database file GM46081 – Progress Report on the 1987 Norbeau Mine Exploration Program by Luke Evans, B.A.Sc., M.Sc., April 1987

- Ministry of Energy and Natural Resources, SIGEOM Database file GM39252 – Diamond Drill Record, Norbeau Property (1981) and GM39252PLAN_1-2

- Ministry of Energy and Natural Resources, SIGEOM Database file GM43254 – Diamond Drilling Program on the Sharpe Vein, Norbeau Property by Jean-Pierre Berube, Ing., December 1985

- Ministry of Energy and Natural Resources, SIGEOM Database file GM69396 – 2015 Exploration Program, Limited Channel Sampling on the No. 5 Vein, Norbeau Property Vein (Preliminary Compilation of Data) Beaurox Mines Ltd. Mining Claims (Dave Malouf), Norbeau Property by Claude P. Larouche, Ing., December 2015

The scientific and technical information in this news release has been reviewed and approved by Andrey Rinta, P.Geo., Exploration Manager of the Corporation, who is a “Qualified Person” within the meaning of National Instrument 43-101.

About Doré Copper Mining Corp.

Doré Copper Mining Corp. is a copper-gold explorer and developer in the Chibougamau area of Québec, Canada. Doré Copper has consolidated a large land package in the prolific Lac Doré/Chibougamau mining camp that has historically produced 1.6 B lbs of copper and 3.2 M oz of gold. In addition, the Corporation has optioned the high-grade Joe Mann gold mine (historical production 1.17 M oz at 8.26 g/t Au). The land package includes 13 former producing mines, deposits and resource target areas within a 60-kilometer radius of the Corporation’s 2,700 tpd mill (Copper Rand Mill).

The Corporation’s current focus is to grow mineral resources and re-develop the high-grade Corner Bay (Cu-Au), Cedar Bay (Au-Cu), and Joe Mann (Au) deposits. The Corporation has resumed its drilling program starting at Corner Bay, which will lead to an updated mineral resource estimate in Q2 2021 and a PEA in H2 2021.

For further information, please visit the Corporation’s website at www.dorecopper.com or refer to Doré Copper’s SEDAR filings at www.sedar.com or contact:

Ernest Mast

President and Chief Executive Officer

Phone: (416) 792-2229

Email:

Laurie Gaborit

VP Investor Relations

Phone: (416) 219-2049

Email:

Cautionary Note Regarding Forward-Looking Statements

This news release includes certain “forward-looking statements” under applicable Canadian securities legislation. Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, “forecast”, “expect”, “potential”, “project”, “target”, “schedule”, “budget” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions and includes the negatives thereof. All statements other than statements of historical fact included in this release, including, without limitation, statements regarding the timing and ability of the Corporation to receive necessary regulatory approvals, and the plans, operations and prospects of the Corporation and its properties are forward-looking statements. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties and other factors which may cause actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to, actual exploration results, changes in project parameters as plans continue to be refined, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, uninsured risks, regulatory changes, delays or inability to receive required regulatory approvals, health emergencies, pandemics and other exploration or other risks detailed herein and from time to time in the filings made by the Corporation with securities regulators. Although the Corporation has attempted to identify important factors that could cause actual actions, events or results to differ from those described in forward-looking statements, there may be other factors that cause such actions, events or results to differ materially from those anticipated. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Corporation disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

- 2025-01-01 Cygnus and Doré Copper Complete Merger

- 2024-12-16 Doré Copper announces shareholder approval of plan of arrangement with Cygnus Metals

- 2024-11-21 Dore Copper Announces Filing And Mailing Of Management Information Circular In Connection With Special Meeting And Encourages Shareholders To Access Meeting Materials Electronically

- 2024-11-05 Dore Copper Provides Update On Arrangement Agreement With Cygnus Metals

- 2024-10-15 Dore Copper and Cygnus Metals Enter Into Arrangement Agreement To Create Strategic Critical Minerals Company

- 2024-09-26 Doré Copper announces closing of $4.676 million non-brokered private placement of common shares and flow-through shares

- 2024-09-04 Dore Copper announces up to $4.62 million non-brokered private placement of common shares and flow-through shares

- 2024-07-24 Dore Copper confirms copper mineralization on its Cedar Bay Southwest Extension

- 2024-07-03 Dore Copper enters into an Agreement to acquire claims next to its flagship Corner Bay High-Grade Copper deposit

- 2024-06-20 Dore Copper announces 2024 annual and special meeting results

- 2024-04-19 Dore Copper announces grant of stock options and deferred share units

- 2024-03-27 Dore Copper identifies gold exploration potential at Norhart Zone, just North of the former Joe Mann mine

- 2024-02-26 Dore Copper announces Management changes

- 2024-01-22 Doré Copper increases size of its Joe Mann Property by acquiring a 65% interest in 3,030 hectares