Download PDF English | French | GERMAN

Toronto, Ontario – October 14, 2021 – Doré Copper Mining Corp. (the “Corporation” or “Doré Copper“) (TSXV: DCMC; OTCQX: DRCMF; FRA: DCM) is pleased to announce an updated mineral resource estimate (“MRE”) for its Devlin copper project. The Devlin deposit is easily accessible, partially developed and located approximately 10 kilometers west of the Corporation’s flagship Corner Bay project and approximately 35 kilometers by road from the Corporation’s Copper Rand mill, near Chibougamau, Québec.

The preliminary economic assessment (“PEA”) for the hub-and-spoke operation model, which includes the Corner Bay deposit as the main feed to the mill along with the Devlin deposit and the former Joe Mann mine as secondary feed sources, is expected to be completed by January 2022.

Highlights of the Devlin Updated MRE

- Measured and Indicated Resource of 775,000 tonnes @ 2.17% Cu and Inferred Resource of 484,000 tonnes @ 1.79% Cu

- Contains 37 million pounds of copper in the Measured and Indicated categories and 19 million pounds of copper in the Inferred category

- Flat-lying deposit less than 100 meters from surface

- Infrastructure in place:

- 305-meter decline access to a vertical depth of 70 meters

- Within trucking distance (35 kilometres) of the Corporation’s 2,700 tpd mill

- Development plan contiguous with Corner Bay benefiting from operational synergies

- Included in the PEA anticipated in January 2022

Ernest Mast, President and CEO of Doré Copper, stated: “Our re-development plan for a hub-and-spoke operation model in the PEA includes our significant high-grade Corner Bay copper-gold project as the main feed to our centralized 2,700 tpd mill, supplemented by the Devlin and Joe Mann deposits. We plan to develop Devlin at the same time as our flagship Corner Bay deposit, which we believe will bring additional tonnes early in the mine life and have operational synergies with Corner Bay.”

The PEA will be using the MRE issued today for Devlin, the October 6, 2021 MRE for Corner Bay (refer to news release October 6, 2021) and the July 28, 2021 MRE for Joe Mann (Technical Report filed on September 10, 2021). A NI 43-101 technical report supporting the MREs for the Corner Bay and Devlin projects will be filed on SEDAR (www.sedar.com) prior to November 20, 2021.

Mineral Resource Estimate for Devlin

The MRE for the Devlin deposit was completed by SLR Consulting (Canada) Ltd. (“SLR”) and is shown in Table 1.

Table 1. Devlin Mineral Resource Estimate (Effective date of October 7, 2021)

| Classification | Tonnage (k t) | Cu Grade (%) | Au Grade (g/t) | Cu Contained (M lbs) | Au Contained (k oz) |

| Measured | 121 | 2.74 | 0.29 | 7.3 | 1.1 |

| Indicated | 654 | 2.06 | 0.19 | 29.7 | 4.0 |

| M+I | 775 | 2.17 | 0.20 | 37.0 | 5.1 |

| Inferred | 484 | 1.79 | 0.17 | 19.2 | 2.7 |

- The stated Mineral Resources comply with the disclosure requirements of National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101") and are classified in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum's "CIM Definition Standards – For Mineral Resources and Mineral Reserves" (the “CIM Definition Standards”).

- Mineral Resources are estimated at a cut-off grade of 1.2% Cu.

- Mineral Resources are estimated using a long-term copper price of US$3.75 per pound, metallurgical copper recovery of 95%, and a US$/C$ exchange rate of 0.75.

- A minimum mining height of 1.8 meters was used.

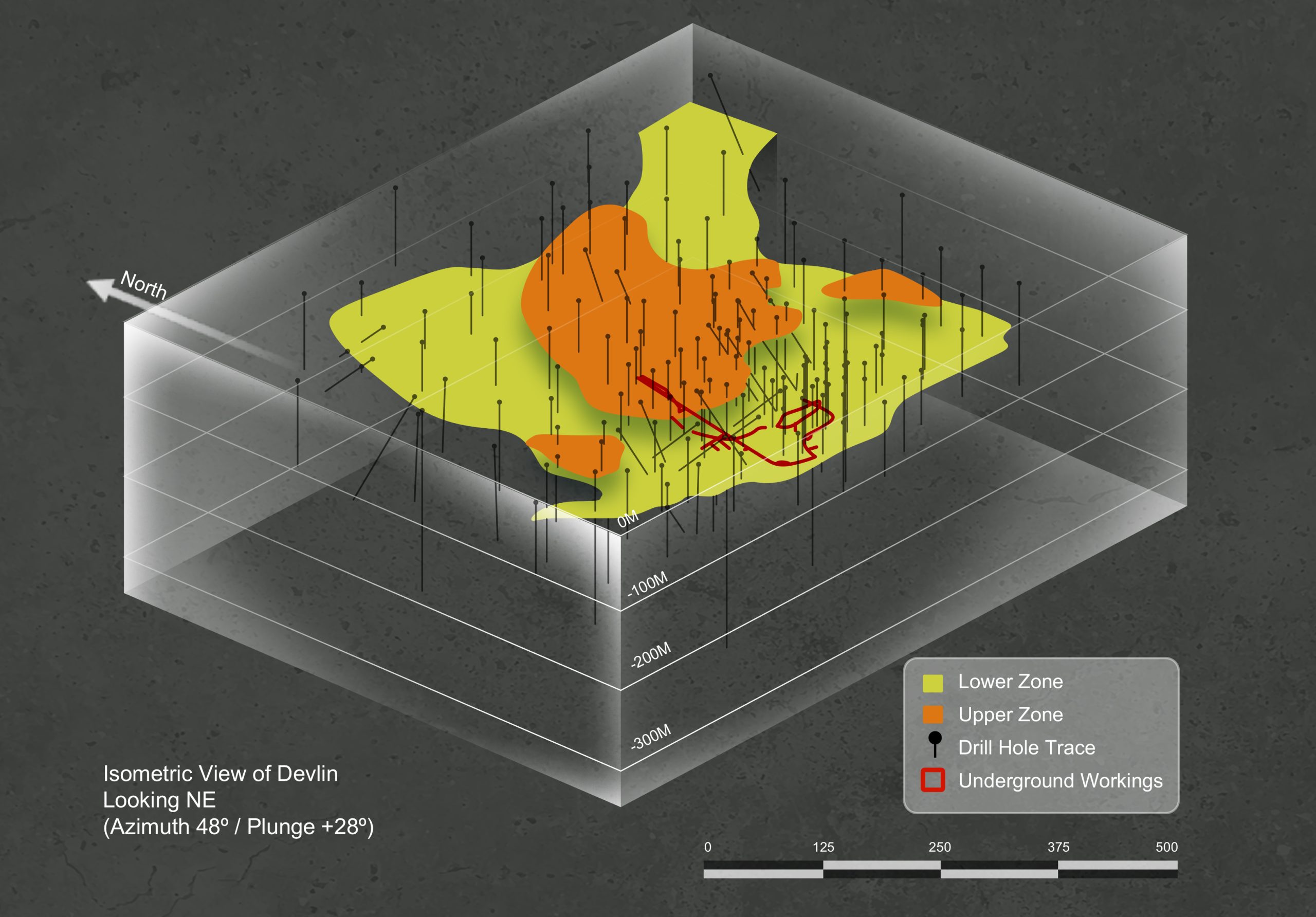

- Bulk density of 2.90 g/cm3 was used for the Lower Zone and 2.85 g/cm3 for the Upper Zone.

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

- Numbers may not add due to rounding.

The MRE utilized a combination of historic holes drilled from 1974 to 1982 and more recent drilling by Nuinsco (CBay Minerals Inc.) from 2013-14. A total of 140 drill holes (out of 174) were used for this MRE with an aggregated length of 14,924 meters. No additional drilling was completed at Devlin since 2014 except for a few holes for metallurgical testing by Doré Copper during summer 2021.

Mineral Resource Estimation Methodology

SLR’s mineral resource update is based on the previous MRE, dated June 30, 2015, that was prepared by Pierre Desautels, P.Geo., of AGP Mining Consultants Inc. (“AGP”) using Gemcom GEMS Version 6.5 software. A block model was built by AGP based on 140 diamond drill holes that intersect the Lower Zone and Upper Zone wireframes (Figure 1). The mineralization wireframes were built by AGP based on a 1.8 meters minimum mining height. Assays were capped to 15% Cu and 2.5 g/t Au in the Lower Zone and were capped to 10% Cu and 1.5 g/t Au in the Upper Zone. Full intersect copper and gold composites were interpolated into 10 meters by 10 meters by 2.5 meters high partial blocks using a three pass, inverse distance squared (ID2) estimation approach. AGP reported the resources base on a 1.6% Cu cut-off grade. SLR reviewed and adopted the AGP block model after making modifications to the classification model whereby the Measured blocks were preserved and a portion of the Inferred blocks were upgraded to Indicated. SLR’s MRE dated October 7, 2021 is based on a 1.2% Cu cut-off grade.

Devlin Copper Deposit

The Devlin deposit is a flat-lying (horizontal) magmatic massive sulphide deposit which is less than 100 meters from surface. The deposit is mainly hosted by a hydrothermal breccia. It is composed of a massive chalcopyrite-pyrite-quartz +/- carbonate vein which pinches and swells. Minor gold is present within the ore body with values typically less than 0.34 g/t. High grade intersections usually consist of one or several parallel quartz veins varying from a few centimeters to 1 meter in thickness, in which the occurrence of chalcopyrite may vary from occasional blebby specks to massive bands. As the mineralogy is very similar to the Corner Bay deposit, the Corporation expects no issues in comingling material from both projects.

The Devlin deposit was drilled by Riocanex (1974-78) and Camchib Resources Inc. (1979-82). In 1981, a 305-meter access decline of 11 ft. x 15 ft. was driven at -15% to a vertical depth of 70 meters, intersecting mineralization at approximately 55 meters below surface. An additional 305 meters of exploration drifting was completed along the vein confirming the continuity and grade of the copper zone. A bulk sample totaling 2,744 short tons of development muck was processed at the Principale mill (dismantled). From an average head grade of 1.26% Cu, a copper concentrate grading 17.79% Cu was obtained with an overall copper recovery of 96.9%. In 1995, Holmer Gold (55% owner of the property) retains Watts Griffis and McOuat Limited (“WGM”) to prepare a technical review of the project. WGM developed a mine plan suggesting a room and pillar approach with a mining rate of 200 tons per day for a total annual production of 50,000 short tons over a mine life of four years. In 2004, Lake Shore Gold acquired Holmer Gold and the Devlin property. The Devlin property was acquired by CBay Minerals Inc. in 2013. CBay Minerals completed 1,749 meters of drilling in 17 holes from 2013-14. In 2015, CBay Minerals reported a NI 43-101 MRE and filed a Technical Report for the Devlin project.

Qualified Persons

The MRE for Devlin was prepared by Luke Evans, M.Sc., P.Eng., ing, and Marie-Christine Gosselin, B.Sc., P.Geo., of SLR, both “Independent Qualified Persons” as defined by NI 43-101. The Qualified Persons are not aware of any environmental, permitting, legal, title, taxation, socio-economic, marketing, political, or other relevant factors that could materially affect the MREs.

Andrey Rinta, P.Geo., the Exploration Manager of the Corporation and a “Qualified Person” within the meaning of National Instrument 43-101, has reviewed and approved the technical information contained in this news release.

About Doré Copper Mining Corp.

Doré Copper Mining Corp. is a copper-gold explorer and developer in the Chibougamau area of Québec, Canada. The Corporation is focussed on implementing its hub-and-spoke development strategy by advancing its key high-grade copper-gold brownfield projects towards a restart of operations. Our goal is to achieve an annual production of 60 Mlbs of copper equivalent (or 100,000 oz gold equivalent).

The Corporation has consolidated a large land package in the prolific Lac Doré/Chibougamau and Joe Mann mining camps that has produced 1.6 billion pounds of copper and 4.4 million ounces of gold1. The land package includes 13 former producing mines, deposits and resource target areas within a 60-kilometre radius of the Company’s 2,700 tpd mill (Copper Rand Mill).

Doré Copper plans to deliver a PEA of its hub-and-spoke model in January 2022. The Corporation is completing its 2021 drilling program of 50,000 meters on its properties in the Lac Doré and Chibougamau area of Québec.

For further information, please contact:

Ernest Mast

President and Chief Executive Officer

Phone: (416) 792-2229

Email:

Laurie Gaborit

VP Investor Relations

Phone: (416) 219-2049

Email:

For more information, please visit: www.dorecopper.com

Facebook: Doré Copper Mining

LinkedIn: Doré Copper Mining Corp.

Twitter: @DoreCopper

Instagram: @DoreCopperMining

1. Sources for historic production figures: Economic Geology, v. 107, pp. 963–989 – Structural and Stratigraphic Controls on Magmatic, Volcanogenic, and Shear Zone-Hosted Mineralization in the Chapais-Chibougamau Mining Camp, Northeastern Abitibi, Canada by François Leclerc et al. (Lac Doré/Chibougamau mining camp) and NI 43-101 Technical Report on the Joe Mann Property dated January 11, 2016 by Geologica Groupe-Conseil Inc. for Jessie Ressources Inc. (Joe Mann mine).

Information Concerning Estimates of Mineral Reserves and Resources

The Mineral Reserve and Mineral Resource estimates in this press release have been disclosed in accordance with NI 43-101, which differs significantly from the requirements of the U.S. Securities and Exchange Commission (the “SEC”), and information with respect to mineralization and Mineral Reserves and Mineral Resources contained herein may not be comparable to similar information disclosed by U.S. companies. The requirements of NI 43-101 for identification of ‘‘reserves’’ are not the same as those of the SEC, and reserves reported by the Company in compliance with NI 43-101 may not qualify as ‘‘reserves’’ under SEC standards. Under U.S. standards, mineralization may not be classified as a ‘‘reserve’’ unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. In addition, and without limiting the generality of the foregoing, this press release uses the terms ‘‘Measured Resources’’, ‘‘Indicated Resources’’ and ‘‘Inferred Resources’’. U.S. investors are advised that, while such terms are recognized and required by Canadian securities laws, the SEC has not recognized them in the past. U.S. investors are cautioned not to assume that any part of a ‘‘Measured Resource’’ or ‘‘Indicated Resource’’ will ever be converted into a ‘‘reserve’’. U.S. investors should also understand that ‘‘Inferred Resources’’ have a great amount of uncertainty as to their existence and as to their economic and legal feasibility. It cannot be assumed that all or any part of ‘‘Inferred Resources’’ exist, are economically or legally mineable or will ever be upgraded to a higher category. Under Canadian securities laws, ‘‘Inferred Resources’’ may not form the basis of feasibility or pre-feasibility studies except in certain cases. Disclosure of ‘‘contained ounces’’ in a Mineral Resource is a permitted disclosure under Canadian securities laws, however, the SEC normally only permits issuers to report mineralization that does not constitute ‘‘reserves’’ by SEC standards as in place tonnage and grade, without reference to unit measures. Accordingly, information concerning mineral deposits set forth in this press release may not be comparable with information made public by companies that report in accordance with U.S. standards.

The SEC has adopted amendments to its disclosure rules to modernize the mineral property disclosure requirements under the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”). These amendments became effective February 25, 2019 (the “SEC Modernization Rules”) with compliance required for the first fiscal year beginning on or after January 1, 2021. Under the SEC Modernization Rules, the historical property disclosure requirements for mining registrants included in Industry Guide 7 under the U.S. Securities Act of 1933, as amended, will be rescinded and replaced with disclosure requirements in subpart 1300 of SEC Regulation S-K. As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources.” In addition, the SEC has amended its definitions of “Proven Mineral Reserves” and “Probable Mineral Reserves” to be “substantially similar” to the corresponding standards under NI 43-101. While the SEC will now recognize “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources”, U.S. investors should not assume that any part or all of the mineralization in these categories will ever be converted into a higher category of Mineral Resources or into Mineral Reserves. Mineralization described using these terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly, U.S. investors are cautioned not to assume that any Measured Mineral Resources, Indicated Mineral Resources, or Inferred Mineral Resources that the Company reports are or will be economically or legally mineable. Further, “Inferred Mineral Resources” have a greater amount of uncertainty as to their existence and as to whether they can be mined legally or economically. Therefore, U.S. investors are also cautioned not to assume that all or any part of the “Inferred Mineral Resources” exist. There is no assurance that any Mineral Reserves or Mineral Resources that the Company may report as “Proven Mineral Reserves”, “Probable Mineral Reserves”, “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources” under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules.

Mineral Resources are not Mineral Reserves, and do not have demonstrated economic viability, but do have reasonable prospects for economic extraction. Measured and Indicated Mineral Resources are sufficiently well defined to allow geological and grade continuity to be reasonably assumed and permit the application of technical and economic parameters in assessing the economic viability of the Mineral Resource. Inferred Mineral Resources are estimated on limited information not sufficient to verify geological and grade continuity or to allow technical and economic parameters to be applied. Inferred Mineral Resources are too speculative geologically to have economic considerations applied to them to enable them to be categorized as Mineral Reserves. There is no certainty that Mineral Resources of any classification can be upgraded to Mineral Reserves through continued exploration.

Cautionary Note Regarding Forward-Looking Statements

This news release includes certain “forward-looking statements” under applicable Canadian securities legislation. Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, “forecast”, “expect”, “potential”, “project”, “target”, “schedule”, “budget” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions and includes the negatives thereof. Specific forward-looking statements in this press release include, but are not limited to, PEA expected in January 2022; development plan for Devlin to be contiguous with Corner Bay, which the Corporation believes will bring additional tonnes early in the mine life and have operational synergies with Corner Bay; implementing a hub-and-spoke development strategy by advancing the Corporation’s key high-grade copper-gold brownfield projects towards a restart of operations; and the Corporation’s goal of achieving an annual production of 60 M lbs of copper equivalent (or 100,000 oz gold equivalent).

All statements other than statements of historical fact included in this release, including, without limitation, statements regarding the timing and ability of the Corporation to receive necessary regulatory approvals, and the plans, operations and prospects of the Corporation and its properties are forward-looking statements. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties and other factors which may cause actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to, actual exploration results, changes in project parameters as plans continue to be refined, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, uninsured risks, regulatory changes, delays or inability to receive required regulatory approvals, health emergencies, pandemics and other exploration or other risks detailed herein and from time to time in the filings made by the Corporation with securities regulators. Although the Corporation has attempted to identify important factors that could cause actual actions, events or results to differ from those described in forward-looking statements, there may be other factors that cause such actions, events or results to differ materially from those anticipated. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Corporation disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

- 2025-01-01 Cygnus and Doré Copper Complete Merger

- 2024-12-16 Doré Copper announces shareholder approval of plan of arrangement with Cygnus Metals

- 2024-11-21 Dore Copper Announces Filing And Mailing Of Management Information Circular In Connection With Special Meeting And Encourages Shareholders To Access Meeting Materials Electronically

- 2024-11-05 Dore Copper Provides Update On Arrangement Agreement With Cygnus Metals

- 2024-10-15 Dore Copper and Cygnus Metals Enter Into Arrangement Agreement To Create Strategic Critical Minerals Company

- 2024-09-26 Doré Copper announces closing of $4.676 million non-brokered private placement of common shares and flow-through shares

- 2024-09-04 Dore Copper announces up to $4.62 million non-brokered private placement of common shares and flow-through shares

- 2024-07-24 Dore Copper confirms copper mineralization on its Cedar Bay Southwest Extension

- 2024-07-03 Dore Copper enters into an Agreement to acquire claims next to its flagship Corner Bay High-Grade Copper deposit

- 2024-06-20 Dore Copper announces 2024 annual and special meeting results

- 2024-04-19 Dore Copper announces grant of stock options and deferred share units

- 2024-03-27 Dore Copper identifies gold exploration potential at Norhart Zone, just North of the former Joe Mann mine

- 2024-02-26 Dore Copper announces Management changes

- 2024-01-22 Doré Copper increases size of its Joe Mann Property by acquiring a 65% interest in 3,030 hectares