TORONTO, Aug. 7, 2020 – Doré Copper Mining Corp. (the “Corporation” or “Doré Copper“) (TSXV: DCMC) is pleased to announce that it has entered into an agreement with Canaccord Genuity Corp., on behalf of itself and a syndicate of agents including Red Cloud Securities Inc. (together, the “Agents“), in connection with a “best efforts” private placement (the “Offering“) of up to approximately C$3 million of common shares of the Corporation (“Common Shares“) that will qualify as “flow-through shares” within the meaning of subsection 66(15) of the Income Tax Act (Canada) (the “Federal Flow-Through Shares“), and, in relation to the Common Shares issued to residents of Québec, section 359.1 of the Taxation Act (Québec) (the “Québec Flow-Through Shares” and together with the Federal Flow-Through Shares, the “Flow-Through Shares“). The Federal Flow-Through Shares will be issued to residents outside of Québec at an issue price of C$1.12 per Federal Flow-Through Share and the Québec Flow-Through Shares will be issued to residents of Québec at an issue price of C$1.20 per Québec Flow-Through Share.

The Corporation has also granted the Agents an option, exercisable in whole or in part at any time up to 48 hours prior to closing of the Offering, which will allow the Agents to sell up to an additional $450,000 of Federal Flow-Through Shares and/or Québec Flow-Through Shares on the same terms.

The Corporation will use an amount equal to the gross proceeds received by the Corporation from the sale of the Flow-Through Shares, pursuant to the provisions in the Income Tax Act (Canada) and the Taxation Act (Québec), to incur eligible “Canadian exploration expenses” that qualify as “flow-through mining expenditures” as both terms are defined in the Income Tax Act (Canada) (the “Qualifying Expenditures“) on or before December 31, 2021, and to renounce all the Qualifying Expenditures in favour of the subscribers of the Flow-Through Shares effective December 31, 2020. In addition, with respect to Québec resident subscribers of the Flow-Through Shares who are eligible individuals under the Taxation Act (Québec), the Canadian exploration expenses will also qualify for inclusion in the “exploration base relating to certain Québec exploration expenses” within the meaning of section 726.4.10 of the Taxation Act (Québec) and for inclusion in the “exploration base relating to certain Québec surface mining expenses or oil and gas exploration expenses” within the meaning of section 726.4.17.2 of the Taxation Act (Québec).

The Offering is expected to close on or about August 25, 2020 and is subject to certain closing conditions including, but not limited to, the receipt of all necessary approvals including the conditional acceptance of the TSX Venture Exchange. The Offering is being made by way of private placement in Canada. The securities issued under the Offering will be subject to a hold period in Canada expiring four months and one day from the closing date of the Offering.

The securities offered have not been registered under the United States Securities Act of 1933, as amended, or any state securities law, and may not be offered or sold in the United States absent registration or an exemption from such registration requirements. This news release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any state in which such offer, solicitation or sale would be unlawful.

About Doré Copper Mining Corp.

Doré Copper is engaged in the acquisition, exploration and evaluation of mineral properties. Doré Copper completed a qualifying transaction on December 13, 2019 establishing itself as a Copper-Gold explorer and developer in the Chibougamau area of Québec, Canada.

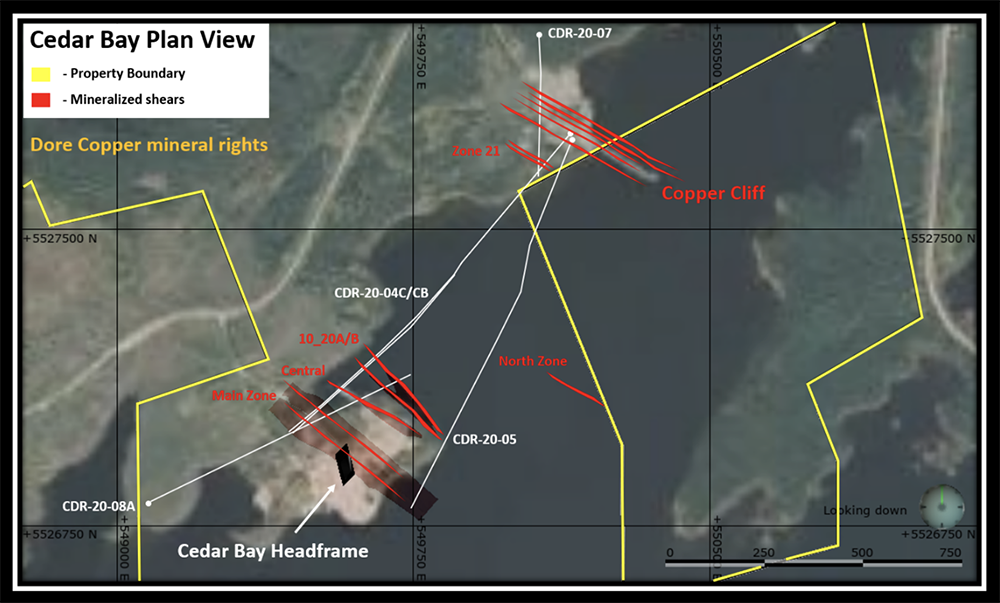

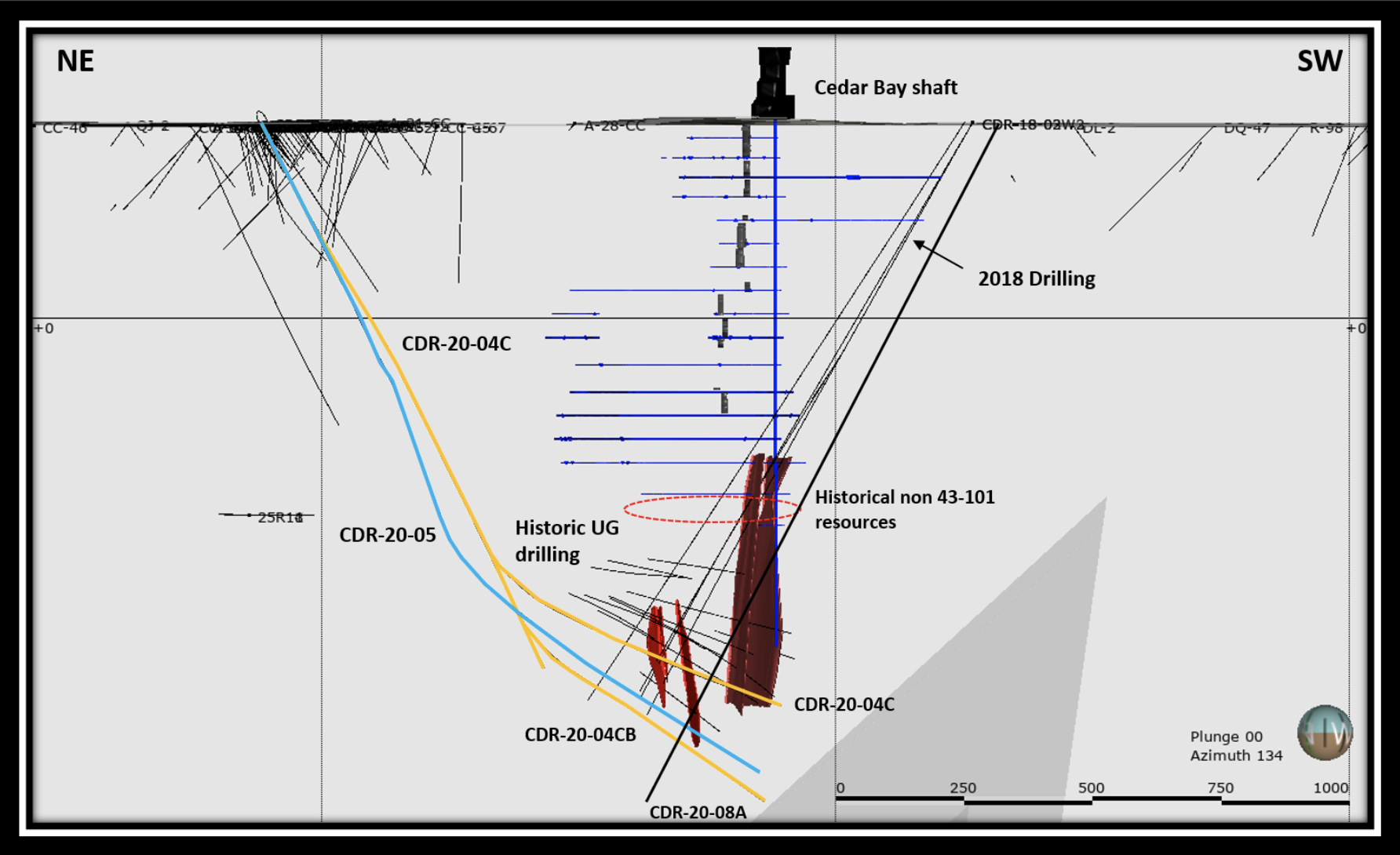

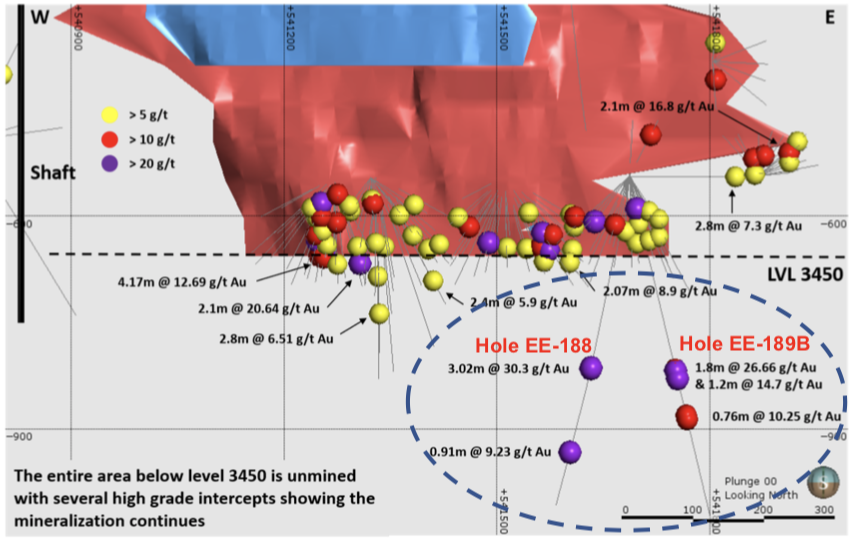

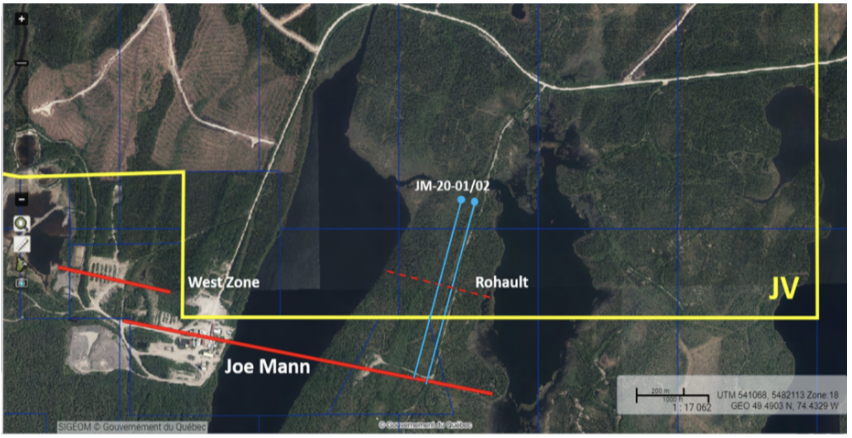

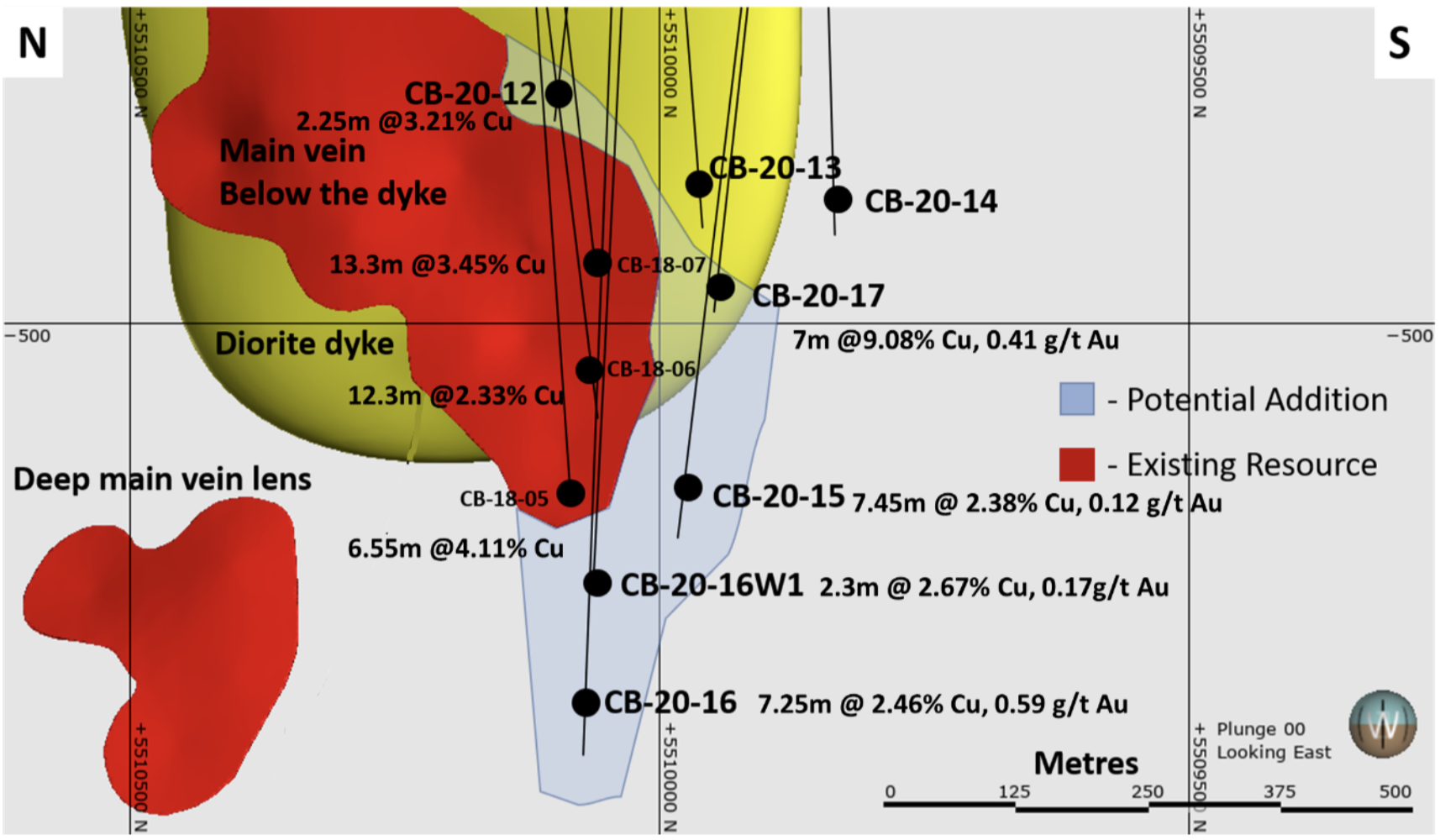

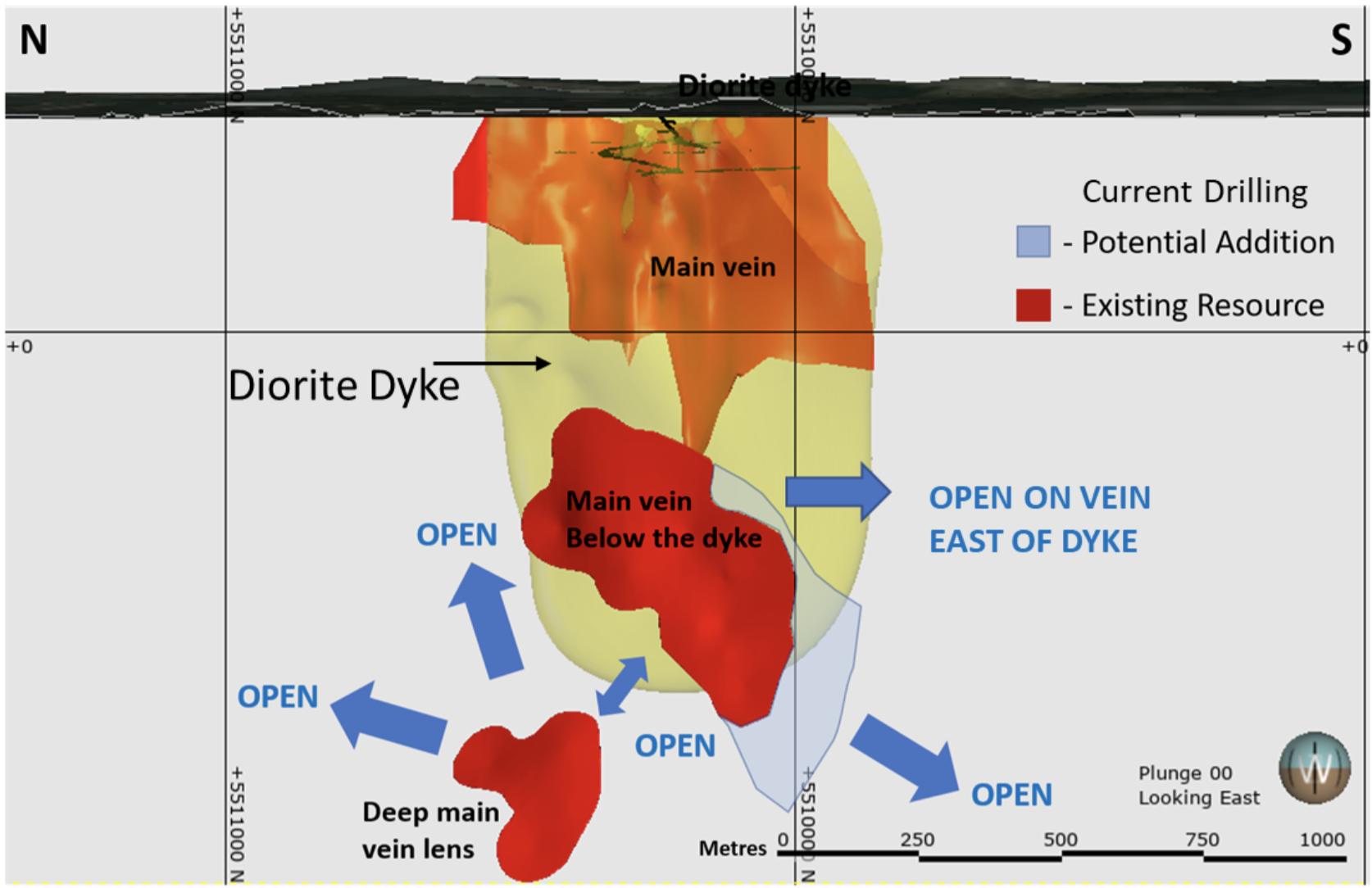

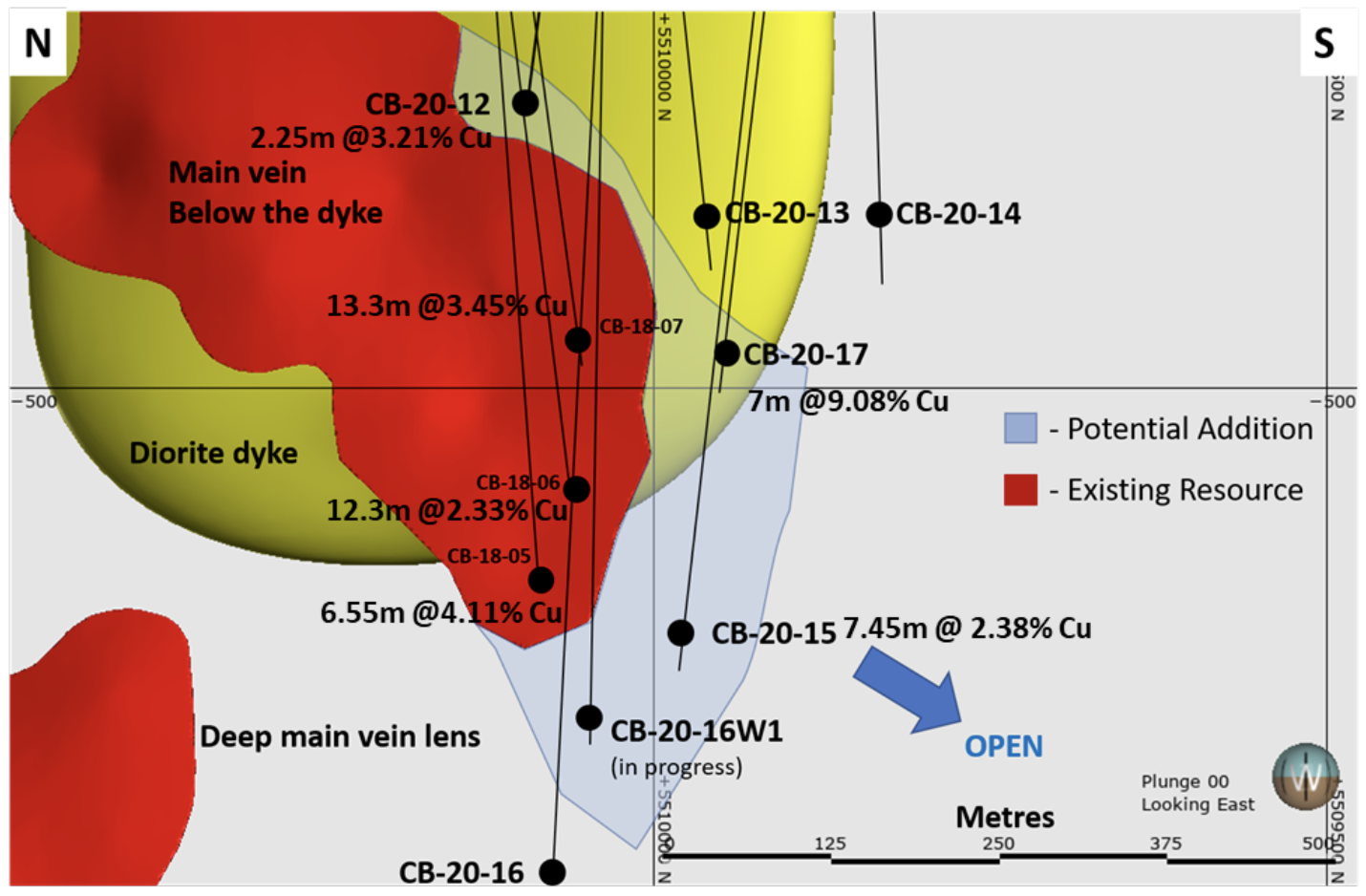

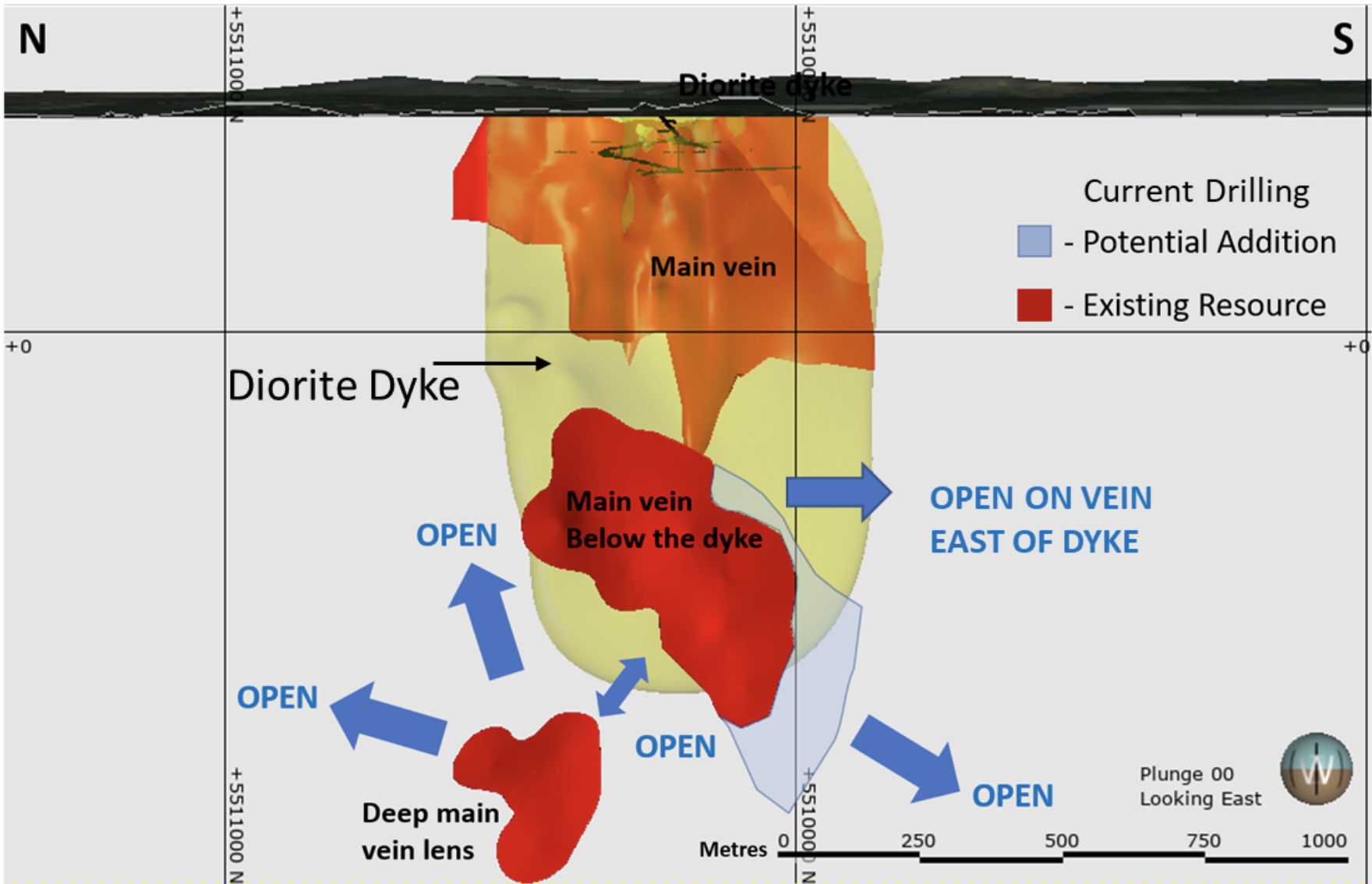

Doré Copper, through its wholly-owned subsidiary CBAY Minerals Inc., holds a 100% interest in the exploration-stage Corner Bay Project and the exploration-stage Cedar Bay Project, and an option to acquire 100% of the past producing Joe Mann gold mine (see press release dated January 2, 2020), all located in the vicinity of Chibougamau, Québec. The Corner Bay Project has an indicated resource of 1.35 Mt at average grades of 3.01% Cu and 0.29 g/t Au, containing 89.8 Mlb of copper and 13,000 ounces of gold, and an inferred resource of 1.66 Mt at average grades of 3.84% Cu and 0.27 g/t Au, containing 140.3 Mlb of copper and 15,000 ounces of gold, assuming a cut-off grade of 1.5% Cu and a copper price of US$3.25 per pound. The Cedar Bay Project has an indicated resource of 130 kt at average grades of 9.44 g/t Au and 1.55% Cu, containing 39,000 ounces of gold and 4.4 Mlb of copper, and an inferred resource of 230 kt at average grades of 8.32 g/t Au and 2.13% Cu, containing 61,000 ounces of gold and 10.8 Mlb of copper, assuming a cut-off grade of 2.9 g/t Au and a gold price of US$1,400 per ounce. Doré Copper’s 2020 drill program at Corner Bay and Cedar Bay has been successful in intercepting mineralization at both Projects. Both deposits are open in various directions along strike and down dip. Both the Corner Bay Project and the Cedar Bay Project are accessible by road and are approximately 20 km apart. Mineralization from both the Corner Bay Project and the Cedar Bay Project would be treated along with material from the Joe Mann mine at Doré Copper’s Copper Rand concentrator located 8 km southwest of Chibougamau, Québec.

For further information, please see the technical report entitled “Technical Report on the Corner Bay and Cedar Bay Projects, Northwest, Québec, Canada” dated June 15, 2019, prepared by Luke Evans, M.Sc., P.Eng., which is available under Doré Copper’s profile on SEDAR at www.sedar.com.

Andrey Rinta, P.Geo., the Exploration Manager of the Corporation and a “Qualified Person” within the meaning of National Instrument 43-101, has reviewed and approved the technical information contained in this news release.

For further information

Ernest Mast

President and Chief Executive Officer

Phone: (416) 792-2229

Email:

Cautionary Note Regarding Forward-Looking Statements

This news release includes certain “forward-looking statements” under applicable Canadian securities legislation. Forward-looking statements include, but are not limited to, statements with respect to the terms of the Offering, the use of proceeds of the Offering, the timing and ability of the Corporation to close the Offering, the timing and ability of the Corporation to receive necessary regulatory approvals, and the plans, operations and prospects of the Corporation. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to: general business, economic, competitive, political and social uncertainties; delay or failure to receive regulatory approvals; the price of gold and copper; and the results of current exploration. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Corporation disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

- 2025-01-01 Cygnus and Doré Copper Complete Merger

- 2024-12-16 Doré Copper announces shareholder approval of plan of arrangement with Cygnus Metals

- 2024-11-21 Dore Copper Announces Filing And Mailing Of Management Information Circular In Connection With Special Meeting And Encourages Shareholders To Access Meeting Materials Electronically

- 2024-11-05 Dore Copper Provides Update On Arrangement Agreement With Cygnus Metals

- 2024-10-15 Dore Copper and Cygnus Metals Enter Into Arrangement Agreement To Create Strategic Critical Minerals Company

- 2024-09-26 Doré Copper announces closing of $4.676 million non-brokered private placement of common shares and flow-through shares

- 2024-09-04 Dore Copper announces up to $4.62 million non-brokered private placement of common shares and flow-through shares

- 2024-07-24 Dore Copper confirms copper mineralization on its Cedar Bay Southwest Extension

- 2024-07-03 Dore Copper enters into an Agreement to acquire claims next to its flagship Corner Bay High-Grade Copper deposit

- 2024-06-20 Dore Copper announces 2024 annual and special meeting results

- 2024-04-19 Dore Copper announces grant of stock options and deferred share units

- 2024-03-27 Dore Copper identifies gold exploration potential at Norhart Zone, just North of the former Joe Mann mine

- 2024-02-26 Dore Copper announces Management changes

- 2024-01-22 Doré Copper increases size of its Joe Mann Property by acquiring a 65% interest in 3,030 hectares