Toronto, Ontario – March 27, 2024 – Doré Copper Mining Corp. (the “Company” or “Doré Copper“) (TSXV: DCMC; OTCQX: DRCMF; FRA: DCM) reports that it has completed its first review of the Norhart mineralized zone, one of the priority gold targets identified on the recently acquired 65% interest in claims surrounding the Company’s 100% owned Joe Mann property. SOQUEM holds the remaining 35% interest in the joint venture (the “Joe Mann SOQUEM JV Property”) (refer to news release dated January 22, 2024).

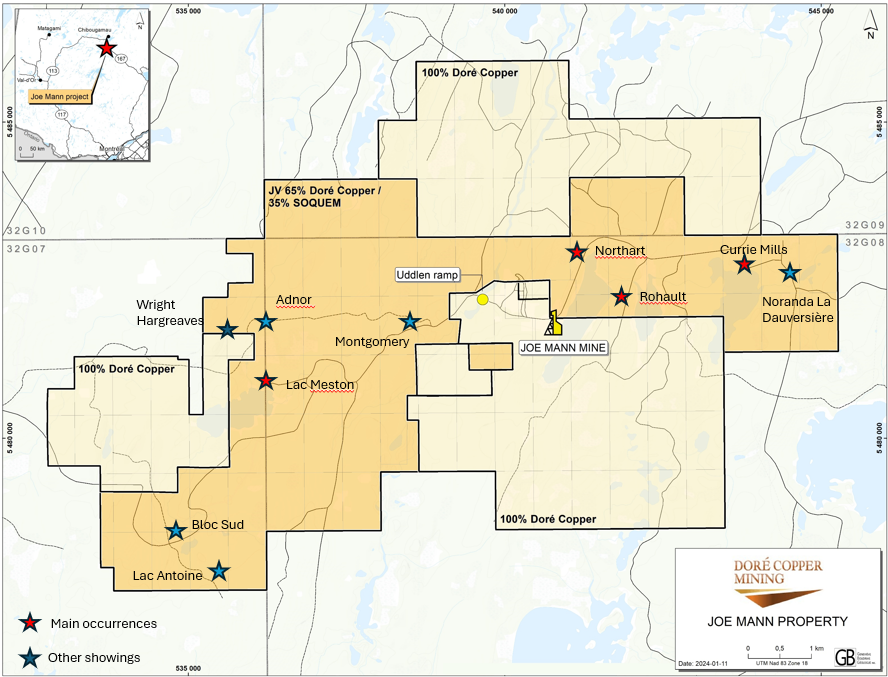

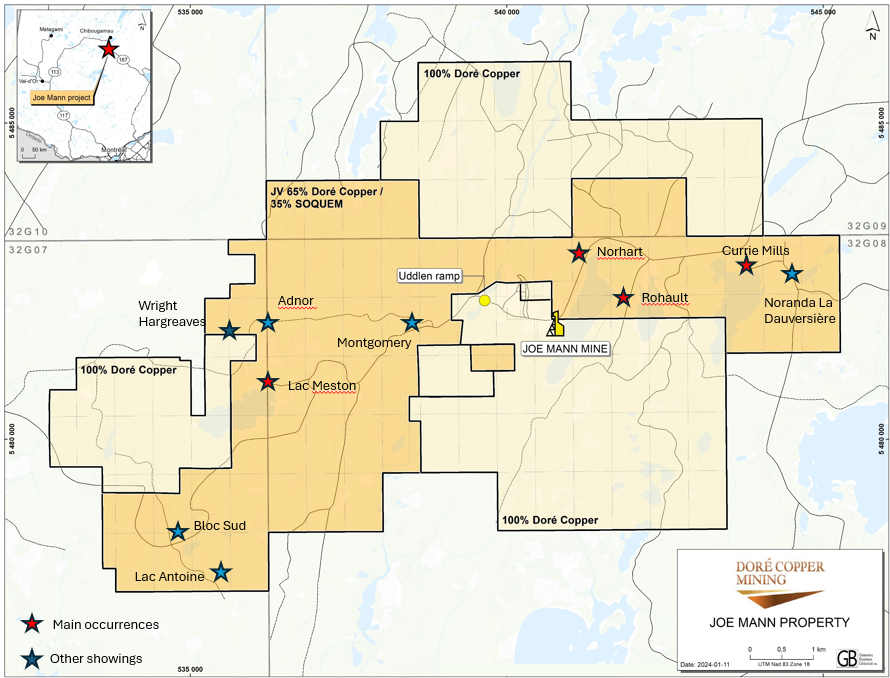

The Norhart gold occurrence is located approximately 1 kilometer north-northeast of the former Joe Mann mine and is easily accessible by road (Figure 1). It is comprised of five parallel east-west, sub-vertical quartz vein structures, each separated by approximately 50 to 150 meters, and traced over a strike length of more than 1 kilometer. Gold mineralization occurs in quartz shear and extensional veins with sulphides (trace to 10%) within an altered sequence of basaltic lava and felsic intrusions.

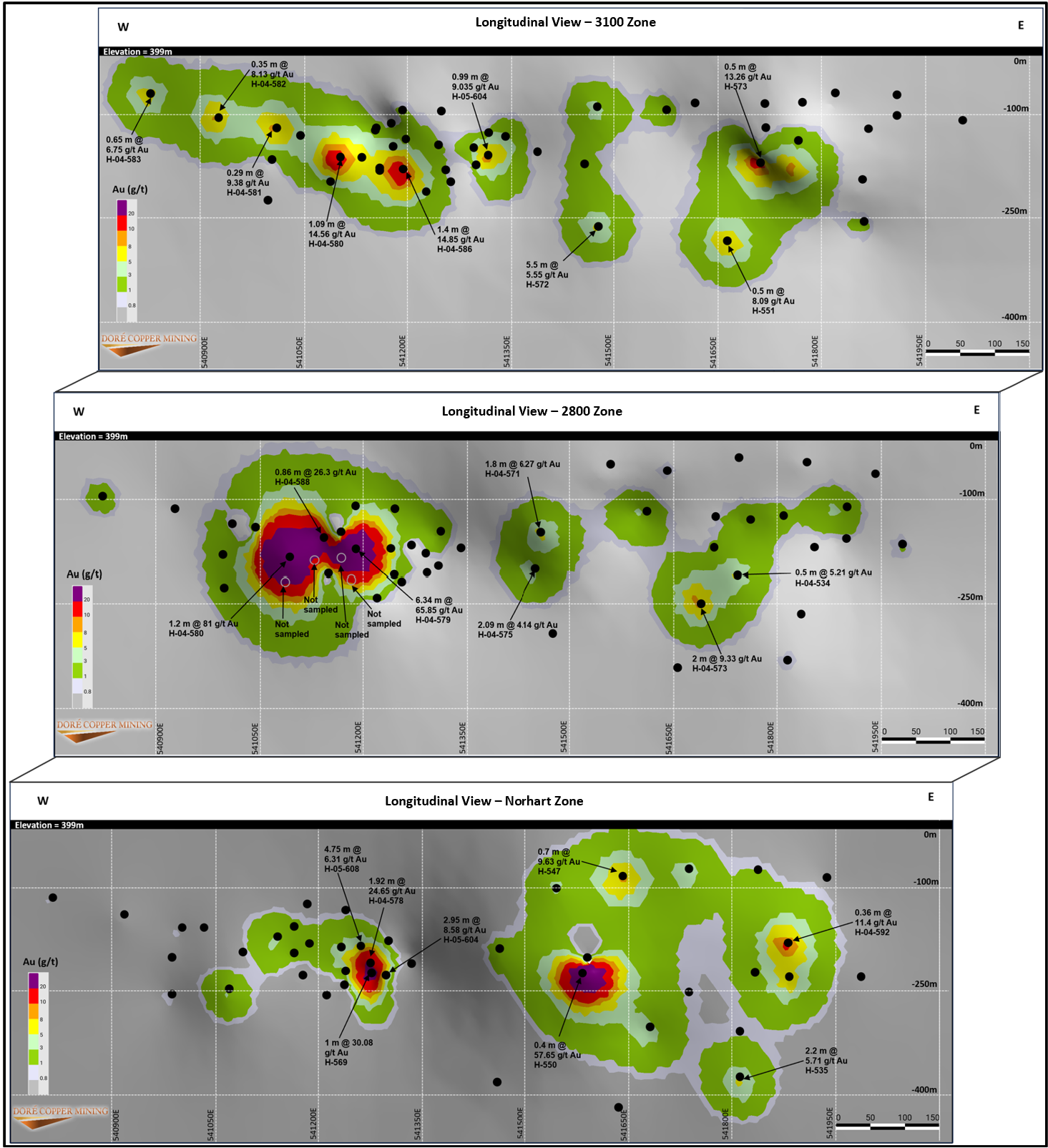

The Norhart zone was discovered in 1995 by SOQUEM. From 1995 to 2005, a total of 68 diamond drill holes totaling 18,569 meters were completed to test the mineralized structures of Norhart over a strike length of 1.2 kilometers to a depth of less than 400 meters. During this period, a total of five parallel auriferous structures known as the Norhart, 2800, 3100, 3500 and 3900 zones were identified. The best gold intercepts were encountered in the 2800 zone, located 50 meters north of the Norhart zone and 2,800 feet (853 meters) north of the Joe Mann shaft. The high-grade gold envelope (intercepts of > 8 g/t Au) has a lateral extension of approximately 200 meters and remains open below 250 meters vertical. Long sections of the 3100, 2800 and Norhart zones (from north to south) are shown in Figure 2.

Ernest Mast, President and CEO of Doré Copper, commented, “The Norhart high-grade gold target merits additional exploration work. The easy access to the Norhart zones, similar mineralogy and gold grades to Joe Mann make Norhart a potential target into the Company’s hub-and-spoke strategy for the Chibougamau mining camp. We plan on reviewing this target with SOQUEM to develop a drill program that will aim at expanding the mineralized zones and verifying historical intercepts.”

Significant historical drill intercepts of the Norhart zones include:1

2800 Zone

- 65.85 g/t Au and 5.9 g/t Ag over 6.34 meters (H-04-579)

- 81.00 g/t Au and 1.4 g/t Ag over 1.2 meters (H-04-580)

- 26.30 g/t Au over 0.86 meter (H-04-588)

- 6.27 g/t Au over 1.8 meters (H-04-571)

- 9.33 g/t Au over 2.0 meters (H-04-573)

3100 Zone

- 14.85 g/t Au over 1.4 meters (H-04-586)

- 14.56 g/t Au over 1.09 meters (H-04-580)

- 5.55 g/t Au over 5.5 meters (H-572)

Norhart Zone:

- 24.65 g/t Au, 17.48 g/t Ag, and 0.79% Cu over 1.92 meters (H-04-578)

- 6.31 g/t Au over 4.75 meters (H-05-608)

- 30.08 g/t Au over 1.0 meter (H-569)

- 8.58 g/t Au over 2.95 meters (H-05-604)

- 57.65 g/t Au over 0.40 meter (H-550)

The Joe Mann Property

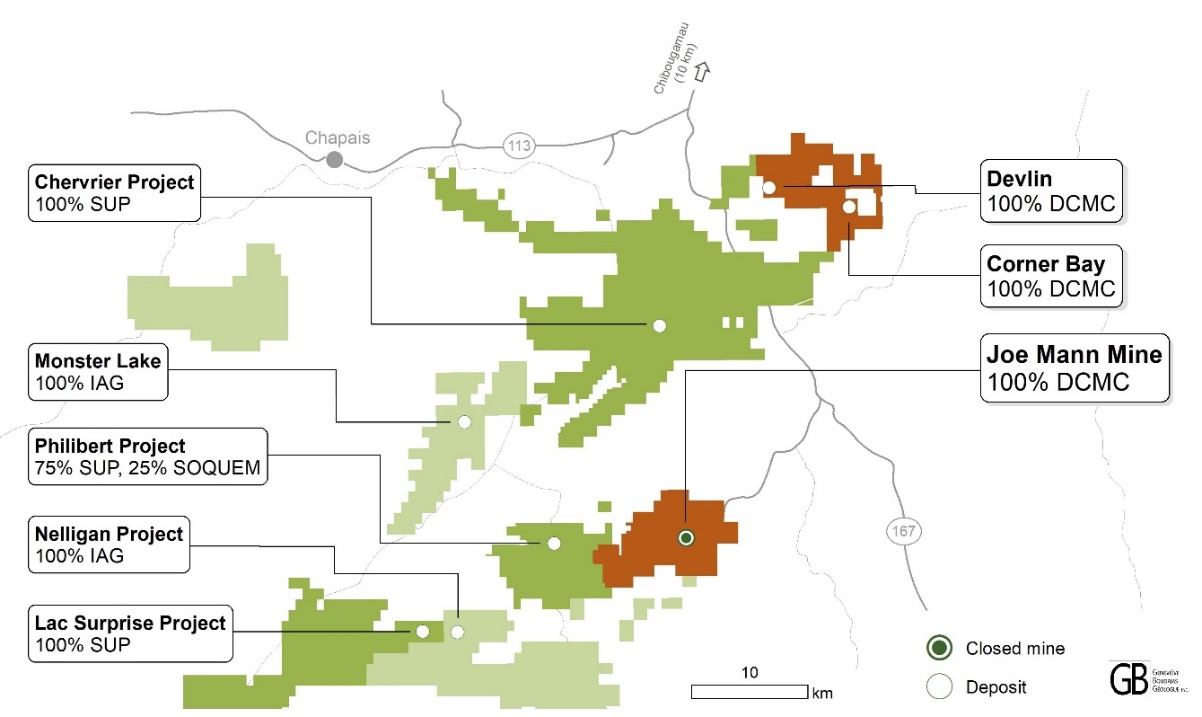

The Company has a controlling interest in a contiguous group of claims totaling 6,209.2 ha surrounding the former high-grade Joe Mann gold mine (Dore Copper has a 100% ownership in 3,179.6 ha and a 65% ownership in 3,029.6 ha, as part of the Joe Mann SOQUEM JV) (Figure 1). The property is located 60 kilometers south of the Company’s Copper Rand mill and part of the southern Chibougamau mining camp where Northern Superior Resources Inc. and IAMGOLD Corporation have identified significant gold mineral resources.

The Joe Mann property is located in the eastern part of the Abitibi Greenstone Belt within the upper part of the Obatogamau Formation, within a major deformation corridor known as the Opawica-Guercheville shear zone. The Company has a 100% interest in the former Joe Mann mine, which produced 1.12 million ounces of gold at an average grade of 8.26 g/t from the 1950s to 2007.1 The deposit has an inferred mineral resource of 680,000 tonnes grading 6.78 g/t Au and 0.24% Cu, which was included in the Company’s Preliminary Economic Assessment (PEA) of its hub-and-spoke operation announced on May 10, 2022.2

A number of gold occurrences and mineralized zones have been identified on the Joe Mann SOQUEM JV Property. No significant exploration work on the joint venture land has been carried out since the late 1990s, except for the Rohault and Norhart gold occurrences where the latest exploration activities took place in 2005.

Disclosure

Youssouf Ahmadou, M.Sc., P.Geo., Senior Exploration Geologist of the Company and a “Qualified Person” within the meaning of National Instrument 43-101 – Standards of Disclosure for Mineral Projects, has reviewed and approved the scientific and technical information contained in this news release.

The Qualified Person (“QP”) for the Company has not verified the historical sample analytical data disclosed within this news release. While the Company has obtained all historic records including analytical data from the previous owners of the property and from various government databases, the Company has not independently verified the results of the historic sampling.

Note: The logs indicate that the core was not sampled at (near) piercing point on Long Section 2800.

Engagement of Arrowhead

Doré Copper has retained Arrowhead Business and Investment Decisions, LLC (“Arrowhead”) to provide marketing services to the Company. Arrowhead has been engaged to elevate market and brand awareness for Doré Copper and to broaden the Company’s reach within the investment community.

Arrowhead has been engaged by the Company for an initial period of six months starting March 15 (the “Initial Term”) and then shall be renewed automatically for successive six-month periods thereafter, unless terminated by the Company in accordance with the Agreement. Arrowhead will be paid a quarterly fee of US$25,000 during the Initial Term. Arrowhead is headquartered in New York City and was founded in 2008.

About Doré Copper Mining Corp.

Doré Copper Mining Corp. aims to be the next copper producer in Québec with an initial production target of +50 Mlbs of copper equivalent annually by implementing a hub-and-spoke operation model with multiple high-grade copper-gold assets feeding its centralized Copper Rand mill.2 The Company has delivered its PEA in May 2022 and is proceeding with a feasibility study.

The Company has consolidated a large land package in the prolific Lac Doré/Chibougamau and Joe Mann mining camps that has historically produced 1.6 billion pounds of copper and 4.4 million ounces of gold.3 The land package includes 13 former producing mines, deposits and resource target areas within a 60-kilometre radius of the Company’s Copper Rand Mill.

About SOQUEM

SOQUEM, a subsidiary of Investissement Québec, is dedicated to promoting the exploration, discovery and development of mining properties in Quebec. SOQUEM also contributes to maintaining strong local economies. A proud partner and ambassador for the development of Quebec’s mineral wealth, SOQUEM relies on innovation, research, and strategic minerals to be well-positioned for the future.

For further information, please contact:

Ernest Mast

President and Chief Executive Officer

Phone: (416) 792-2229

Email:

Laurie Gaborit

VP Investor Relations

Phone: (416) 219-2049

Email:

For more information, please visit: www.dorecopper.com

Facebook: Doré Copper Mining

LinkedIn: Doré Copper Mining Corp.

Twitter: @DoreCopper

Instagram: @DoreCopperMining

- GM 62760: Ressources Meston Inc. Forage Printemps et Automne 2004, Propriete Joe Mann, Secteurs Norhart et Rohault, by Denis McNicholes, geo, dated April 8, 2005.

- Sources for historic production figures: Economic Geology, v. 107, pp. 963–989 – Structural and Stratigraphic Controls on Magmatic, Volcanogenic, and Shear Zone-Hosted Mineralization in the Chapais-Chibougamau Mining Camp, Northeastern Abitibi, Canada by François Leclerc et al. (Lac Dore/Chibougamau mining camp) and NI 43-101 Technical Report on the Joe Mann Property dated January 11, 2016 by Geologica Groupe-Conseil Inc. for Jessie Ressources Inc. (Joe Mann mine).

- Technical report titled “Preliminary Economic Assessment for the Chibougamau Hub-and-Spoke Complex, Québec, Canada” dated June 15, 2022, in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects. The Technical Report was prepared by BBA Inc. with several consulting firms contributing to sections of the study, including SLR Consulting (Canada) Ltd., SRK Consulting (Canada) Inc. and WSP Inc.

Cautionary Note Regarding Forward-Looking Statements

This news release includes certain “forward-looking statements” under applicable Canadian securities legislation. Forward-looking statements include predictions, projections and forecasts and are often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, “forecast”, “expect”, “potential”, “project”, “target”, “schedule”, “budget” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions and includes the negatives thereof. All statements other than statements of historical fact included in this news release, including, without limitation, statements with respect to the timing and ability of the Company to receive necessary regulatory approvals, the Company’s ability to meet its production target, the commencement, timing and completion of a feasibility study, and the plans, operations and prospects of the Company and its properties are forward-looking statements. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties and other factors which may cause actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to, actual exploration results, changes in project parameters as plans continue to be refined, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, uninsured risks, regulatory changes, delays or inability to receive required regulatory approvals, health emergencies, pandemics and other exploration or other risks detailed herein and from time to time in the filings made by the Company with securities regulators. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ from those described in forward-looking statements, there may be other factors that cause such actions, events or results to differ materially from those anticipated. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

- 2025-01-01 Cygnus and Doré Copper Complete Merger

- 2024-12-16 Doré Copper announces shareholder approval of plan of arrangement with Cygnus Metals

- 2024-11-21 Dore Copper Announces Filing And Mailing Of Management Information Circular In Connection With Special Meeting And Encourages Shareholders To Access Meeting Materials Electronically

- 2024-11-05 Dore Copper Provides Update On Arrangement Agreement With Cygnus Metals

- 2024-10-15 Dore Copper and Cygnus Metals Enter Into Arrangement Agreement To Create Strategic Critical Minerals Company

- 2024-09-26 Doré Copper announces closing of $4.676 million non-brokered private placement of common shares and flow-through shares

- 2024-09-04 Dore Copper announces up to $4.62 million non-brokered private placement of common shares and flow-through shares

- 2024-07-24 Dore Copper confirms copper mineralization on its Cedar Bay Southwest Extension

- 2024-07-03 Dore Copper enters into an Agreement to acquire claims next to its flagship Corner Bay High-Grade Copper deposit

- 2024-06-20 Dore Copper announces 2024 annual and special meeting results

- 2024-04-19 Dore Copper announces grant of stock options and deferred share units

- 2024-03-27 Dore Copper identifies gold exploration potential at Norhart Zone, just North of the former Joe Mann mine

- 2024-02-26 Dore Copper announces Management changes

- 2024-01-22 Doré Copper increases size of its Joe Mann Property by acquiring a 65% interest in 3,030 hectares